Volume is a crucial factor of market evaluation, imparting valuable insights into the energy and path of price movements. In NinjaTrader, a leading trading platform, volume indicators play a major role in assisting traders make knowledgeable trading choices. By understanding how to interpret and make use of the NinjaTrader volume indicator efficiently, traders can enhance their trading strategies and attain higher effects. In this blog, we will discover some essential extent indicator techniques in NinjaTrader that every trader needs to realize.

Volume Profile Analysis:

NinjaTrader offers a powerful Volume Profile indicator that shows volume distribution across rate ranges. Traders can use this profile to pick out key aid and resistance degrees primarily based on tremendous extent clusters. By focusing on areas in which volume is concentrated, traders can count on potential price reactions and plan their trades accordingly.

Volume Weighted Average Price (VWAP):

The VWAP indicator in NinjaTrader calculates the common price of a safety weighted by way of trading extent. Traders often use VWAP as a benchmark to evaluate the equity of modern-day marketplace fees. Additionally, VWAP can serve as a dynamic assist or resistance degree, with the rate often gravitating closer to it throughout intraday buying and selling classes.

Volume Oscillator:

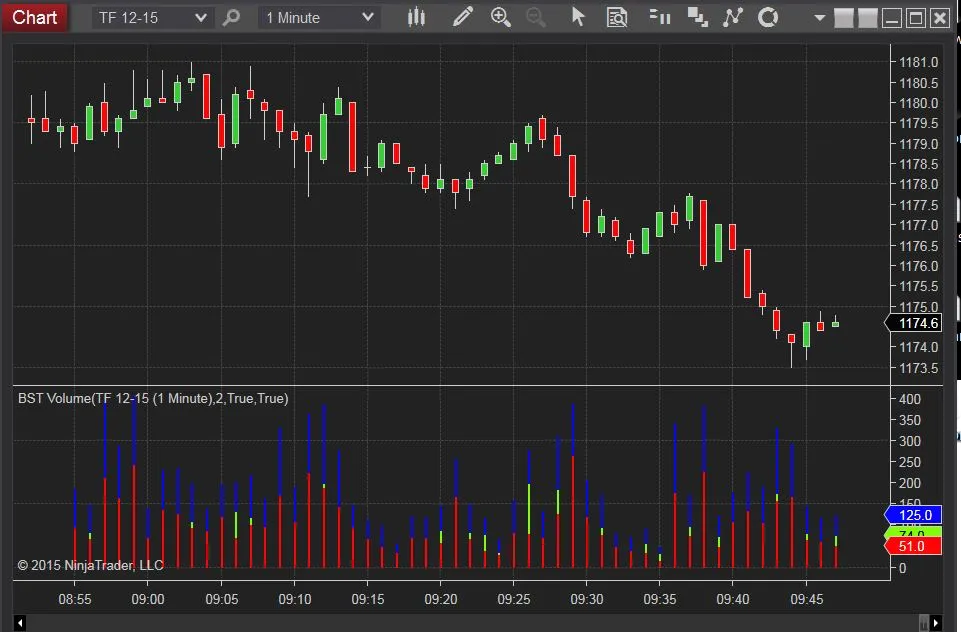

The Volume Oscillator indicator in NinjaTrader compares two volume transferring averages to become aware of adjustments in volume momentum. Traders can use the Volume Oscillator to hit upon bullish or bearish indicators primarily based on the crossover of the two-volume averages. Additionally, the divergence between volume and rate can sign potential fashion reversals or continuation patterns.

Cumulative Delta:

Cumulative Delta is a unique NinjaTrader volume indicator that tracks the buying and selling stress in the marketplace by comparing the number of upticks and downticks. Traders can use Cumulative Delta to perceive imbalances between buyers and sellers, which could precede good-sized price movements. By tracking Cumulative Delta along rate motion, investors can gain insights into market sentiment and potential fashion reversals.

Wrapping it up

Ultimately, NinjaTrader volume indicator offers treasured gear for reading market dynamics and helps in making knowledgeable trading selections. By incorporating volume analysis into their trading strategies, traders can benefit from deeper expertise of market value and pick out high-opportunity trading possibilities. Whether it’s the usage of Volume Profile to discover guide and resistance ranges, VWAP as a benchmark for intraday trading, or OBV to verify rate traits, getting to know volume indicator strategies can drastically enhance your trading performance in NinjaTrader. Experiment with specific volume signs and techniques to find the ones that suit your trading style and goals. With practice and experience, volume analysis can grow to be a valuable asset to your trading toolkit.

Finally, ensure your safety and security while investing your capital in trading. All your investments are subject to market risks, so please be careful before investing. Visit ninZa.co today to learn more about the strategies and avail yourself of their best deals and offers. You can also get a welcome gift at their site on your first purchase, so hurry up and get the best deals before the time runs out. Have a happy day trading with Ninza.Co only!